[ad_1]

Dyn Therapeutics, Inc. (NASDAQ:DYN) Chief Business Officer Jonathan McNeil sold 20,000 shares of the company’s stock on January 26, 2024, according to a recent SEC filing. The transaction was carried out at an average price of $24.53 per share, for total gross proceeds of $490,600.

Dyne Therapeutics Inc is a biotechnology company focused on developing life-changing treatments for patients with serious muscle diseases. The company leverages its proprietary FORCE platform to enhance the delivery of therapeutics to muscle tissue.

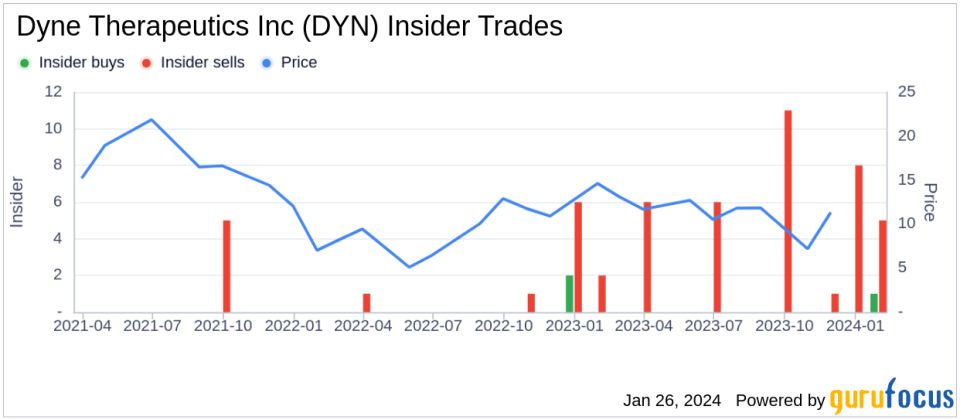

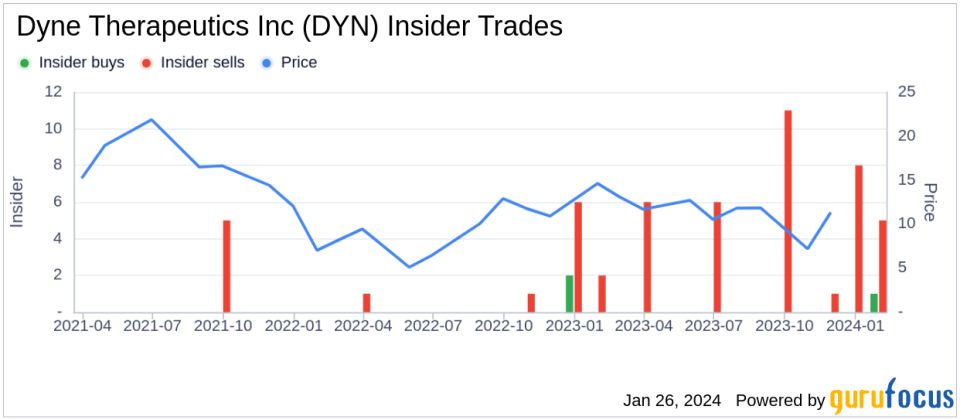

Over the past year, insiders have sold a total of 60,140 shares of Dyn Therapeutics Inc. stock, but did not buy any shares. The recent insider selling is part of a series of transactions observed over the past twelve months.

Dyne Therapeutics’ insider trading history shows a pattern of insider sales, with 39 insider purchases recorded over the past year, compared to just 1 during the same period.

On the latest insider trading day, shares of Dine Therapeutics, Inc. were trading at $24.53, giving the company a market cap of $1.66 billion.

Investors and analysts often monitor insider transactions because they can gain insight into company insider views on a stock’s value and future performance. However, it is important to consider a wide range of factors when assessing the impact of insider trading activity.

This article created by GuruFocus is intended to provide general insight and is not intended as financial advice. Our commentary is based on historical data and analyst forecasts using an unbiased methodology and is not intended to serve as specific investment guidance. It does not constitute a recommendation to buy or sell stocks, and does not take into account your individual investment objectives or financial situation. Our objective is to provide fundamental data-driven analysis over time. Please note that our analysis may not incorporate the latest announcements or qualitative information from price-sensitive companies. GuruFocus has no position in the stocks mentioned herein.

This article first appeared on GuruFocus.

[ad_2]

Source link